What are carbon credit markets?

A carbon credit is a transferable instrumentcertified by governments or private entities, that represents one tonne of carbon dioxide equivalent (tCO2e) that a project can either avoid or reduce compared to a baseline,or absorb from the CO2 already present in the atmosphere. These projects can use natural solutions, such as deforestation prevention (reduction) or reforestation (removal), or technological solutions, such as renewables (reduction) or direct air capture of CO22 also known as DAC (removal).

Most credit purchases are driven by a voluntary motivation on the part of companies, governments, and individuals to contribute to their climate goals. This has given rise to what is known as the voluntary carbon credit market (VCM), even though there are some cases in which its purchase is required or promoted by a regulatory framework.

Voluntary markets work differently to regulated carbon markets, also known as ETS (Emissions Trading System), which exist in several regions of the world, including the European Union. These sell emission allowances under the “polluter pays” principle (the obligation to pay for emissions).

Why are they important?

Together with the priority of far-reaching decarbonisation, the United Nations highlights the fact that, to achieve the goal of keeping the temperature increase below 1.5°C, we also need to increase the removal of carbon from the atmosphere and guarantee the protection and restoration of nature. However, current policies are not bringing us closer to this goal and there is a significant funding gap for innovation and for scaling up the necessary solutions.

This is the case with many nature-based solutions, such as conserving and restoring forests, which play an essential role in reducing and removing emissions but are insufficiently funded. The United Nations has estimated that the funds spent on these solutions must double by 2025 and triple by 2030 to meet global climate and biodiversity goals.

In this context, carbon credit markets constitute an essential component of climate policy, mobilising, at speed and scale, the urgently needed public and private funding. The income from selling credits allows the development of a wide range of projects that contribute to global mitigation but would otherwise be uneconomic and could not be funded.

At the same time many of these projects:

Help scale and reduce the cost of emerging and innovative solutions.

Generate broader environmental, social and economic benefits (e.g. biodiversity).

Generate cross-border capital flows, especially to developing economies, which have great potential for development but involve greater barriers.

They therefore play an important role in a scenario in which each sector and region starts from a different point of carbon dependence, some lacking viable technical options for immediate decarbonisation but with the capacity to finance projects with high mitigation potential as they progress with their decarbonisation pathway.

How are carbon credits generated, marketed and used?

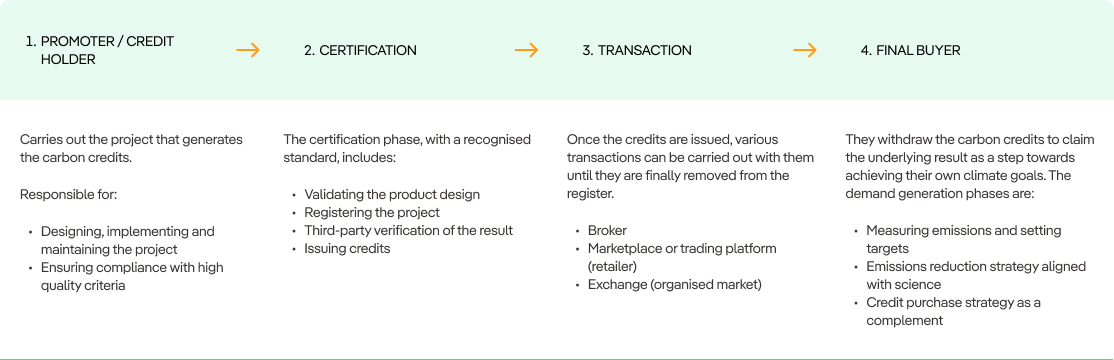

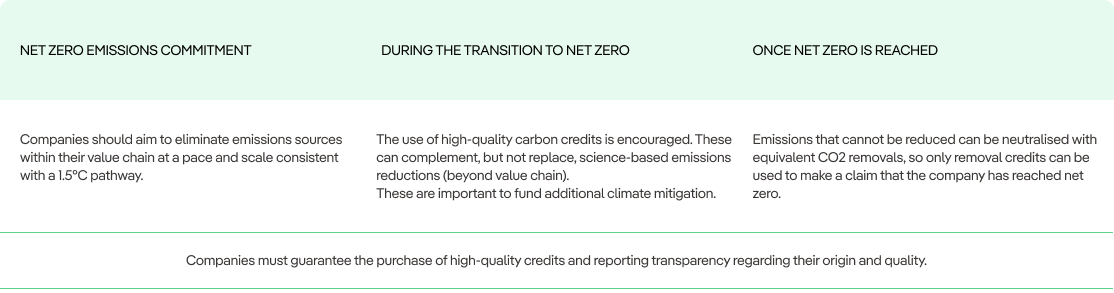

For a project to generate credits, it must be registered and certified with a recognised standard that guarantees its quality and prevents double accounting. Once issued, they can pass through several intermediaries before being finally withdrawn from the market by the final buyer, who can claim the underlying result towards achieving their own climate goals. De esta manera, permite a las empresas utilizarlos como complemento en el marco de estrategias ambiciosas de descarbonización alineadas con la ciencia, para neutralizar sus emisiones residuales o financiar mitigación climática adicionalIn this way, companies can use them as an additional tool within the framework of ambitious science-based decarbonisation strategies to neutralise their residual emissions or fund additional climate mitigation.

What is the situation in this market

Driven by net zero emissions targets, the voluntary carbon market is maturing and consolidating. There are important dynamics of change marked by new players entering the market and the establishment of a new quality framework, with promising, regulations, initiatives and technologies that help generate trust in the market and in the legitimate use of credits in ambitious decarbonisation strategies.

Some of the notable initiatives are:

In guaranteeing the quality of credits, Integrity Council for Voluntary Carbon Markets (IC-VCM) is particularly important. It has established the common principles that projects issuing carbon credits must comply with (Core Carbon Principles) and the procedures to validate the standards that can issue eligible “CCP” credits.

To ensure quality in their use and prevent greenwashing practices, the net zero emissions standard of the “Science-Based Targets (SBTi)” initiative and the Voluntary Carbon Markets Integrity Initiative establish a legitimate framework for using credits in corporate net zero emissions strategies:

We hope that this introduction to the carbon credit markets has helped you understand the nature of this sector a little better. We will gradually update our opinion articles, adding more information of interest about this project and its related subjects.. We invite you to follow our blog to stay tuned for news and be able to delve deeper into this topic.